Finance

Corporate Tax Services

Orporate taxes can be a headache given the various facets of many businesses. Instead of hiring a group of accountants to look at this aspect of your business, you can contract the service of corporate tax consultants. These are specially-trained individuals who analyze the books of a given business and go on to make sure that all taxes are paid according to corporate government law.

Your business runs on a fine balance of assets and liabilities, and it is the work of corporate tax firms to ensure that you have a clear idea how you are able to minimize one while capitalizing and protecting the other.

Whether you’re a small business or a large corporation with branches countrywide, corporate tax services let you organize your business in a way that insures profitability. Sometimes, you might qualify for tax rebates and not even know it. It is the responsibility of these tax firms to help you save money where possible. You can then go on to cycle this saved money back into your business.

Tax laws and interpretations are subject to change, and accountants are not enough when it comes to understanding how these laws work and their implications to the average business. A corporate tax firm works with you hand-in-hand to break down these laws into language that is easily understood. While coming up with yearly targets and plans, you can make sure that you take these laws into consideration in order to stay on the right side of the law.

Minimizing the amount of tax you pay is also possible. For example, a corporate tax firm will show you ways you can streamline certain areas of your business to get rid of unnecessary taxation. Also, areas such as provincial, payroll and capital taxes can be streamlined, helping you save on your final tax bill.

Here are some of the activities that a corporate tax firm will help you with:

- Preparation and filing of tax returns, installments and estimates

- Advice on the merits of tax deferral, as well as filing positions

- Quarterly tax payments and estimates.

Long-term use of corporate tax services will give you a unique insight into the running of your company. Most people assume that if you have an in-house book keeper or accountant you don’t need tax consultants to look at your books. The fact is, most departments of any business have a hard time consolidating their tax details into a central depository. This leads to loss of time and resources as companies struggle to consolidate information from these different departments.

A corporate tax firm provides you with a service that lets you see your corporate entity as one organism capable of effectively managing its taxation issues – with a bit of help from qualified corporate tax consultants. Customized tax solutions are what corporations need, and this is something that can be achieved with experienced corporate tax firms. Get in touch with one today, and help your business run more efficiently once and for all.

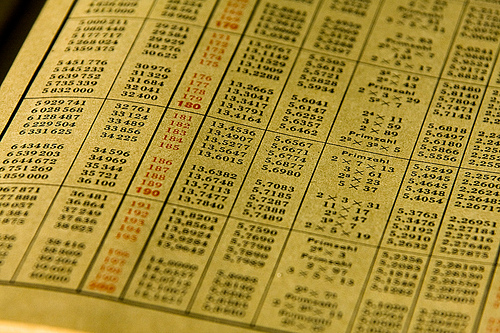

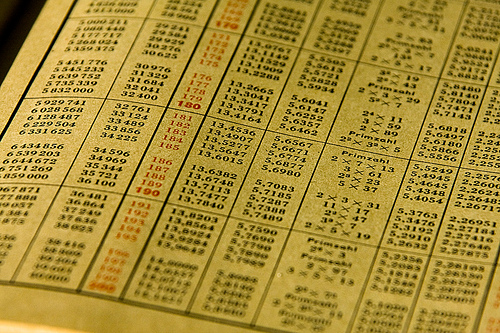

Featured images:

- License: Creative Commons image source

Thanks for taking the time to evaluate this article on Corporate Tax Services. For related information be sure to check back next week!

-

Tech11 years ago

Tech11 years agoCreating An e-Commerce Website

-

Tech11 years ago

Tech11 years agoDesign Template Guidelines For Mobile Apps

-

Business6 years ago

Business6 years agoWhat Is AdsSupply? A Comprehensive Review

-

Business10 years ago

Business10 years agoThe Key Types Of Brochure Printing Services

-

Tech8 years ago

Tech8 years agoWhen To Send Your Bulk Messages?

-

Tech5 years ago

Tech5 years ago5 Link Building Strategies You Can Apply For Local SEO

-

Law5 years ago

Law5 years agoHow Can A Divorce Lawyer Help You Get Through Divorce?

-

Home Improvement6 years ago

Home Improvement6 years agoHоw tо Kеер Antѕ Out оf Yоur Kitсhеn