Business

Taking Advantage from CRM In Banking

The more flexible your company is – the more chances it has to prosper in the world of hyper-competitiveness where every business strives to offer the superior level of service. Customer attrition is a burden for a financial sector. Companies are supposed to understand, predict and fulfill to the fullest all the customers’ expectations and needs. That is why CRM in banking turns out to be extremely essential for any business. Knowing what your buyer really wants, you can build a solid community of loyal clients. Any bank with an objective of attracting as many clients as possible and closing financial deals repeatedly will definitely appreciate smart CRM tools.

Banking CRM that is developed by http://www.bpmonline.com/financial-services is aimed to automate all business processes when it comes to customer relationship management. For instance, a truly advanced automation solution like bpm’online can:

- facilitate customer’s lifecycle;

- find the most adequate ways of personalized communication with your clients;

- promote up-selling and cross-selling of your bank products;

- make the services and products you offer correspond to the clients’ demands;

- control the activity of the sales team to help them be more productive and multiply your bank’s profits;

- CRM in banking will intelligently arrange customer relationship in order to manage noticeable rise of income.

Evidently, advanced CRM in banking can provide numerous automation solutions with a single goal of making your bank incredibly efficient. In result, you will be able to deliver the products and services your customers actually need, which will definitely make their lives easier. Let us take a closer look at the core benefits of financial CRM:

CRM in Banking as a Way to Improve Multichannel Interactions with Clients

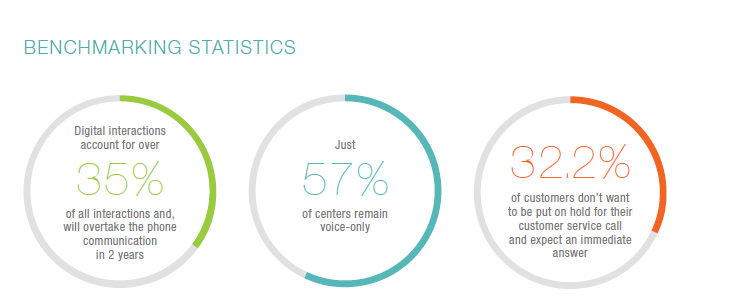

Clients always want to get the best from your bank with their demands constantly increasing. To get a hold of your client, your sales professionals and marketers have to keep a fruitful dialog with them via different communication channels and devices. According to recent studies, a great deal of customers (nearly 83%) would choose the bank, which could offer multiple communication channels for the customers to interact with your financial organization. And 56% of respondents prefer a bank, where customer support can provide an immediate assistance via social networks. Usually, the interactions with clients are performed through call-centers, bank offices, mobile banking applications or online chat with a bank manager and, of course, ATMs.

The matter is that all these communicative means operate discretely. An overwhelming amount of data that your employees have to process is not well-managed, which can badly affect customer experience. Fortunately, there is always a way-out. Integrating an advanced CRM software will make your bank break new ground in personalized multichannel customer relationships, where your managers will get in contact with a client directly from a CRM system. The beauty of this software is that it provides your team with efficient contact management tools, which guarantees failure-proof performance and ultimate satisfaction of any client whatever communicative means or device they may use. With such software your financial firm can provide individual approach to your clients with high-end banking experience.

Get a Better Understanding of your Clients Better

The key to success is to know what your client needs and offer them a product or service with due time. Banking CRM provides your financial organization with a better view of your customers by creating a unified database of potential and real customers and partners. With such an efficient automation solution, you will no longer worry about the safety and protection of your clients’ personal information; and the problem of contacts duplicating will be long gone as well. Other tasks that financial CRM deals with include:

- legal entity profiles management;

- contact data creation and update including bank accounts and cards;

- storage of client interactions history including all the services and products, which were offered and sold (transactions overview and contracts concluded);

- CRM in banking is equipped with automation tools like emailing and tracking of website behavior. That way, your financial institution becomes able to suggest a relevant product to a customer at any time;

- Having deployed an up-to-date CRM system, your bank can develop effective business strategies and find advantageous communication means to provide a client with a first-class service.

Keep Valuable Customer Data Secured

Integrating an online CRM software is a tempting for business of any scale, as the benefits of cloud based deployment include quick installation, easy customization, trouble-free access and comprehensive compatibility with other software. Though, there is one crucial point which online CRM seemingly lacks – data security. There is a deep-rooted fear that cloud based CRMs are not as safe as their on-premise version. However, this statement is no longer true. Contemporary cloud CRMs are fully aware of how important it is for all the banks to keep their clients’ data absolutely protected from an unauthorized access. That is why, banking CRMs offer a super-high level of data security and data recovery at the server level as the key features. All your data is safely stored and constantly backed up with progressive technologies, which prevent data breaches.

-

Tech11 years ago

Tech11 years agoCreating An e-Commerce Website

-

Tech11 years ago

Tech11 years agoDesign Template Guidelines For Mobile Apps

-

Business6 years ago

Business6 years agoWhat Is AdsSupply? A Comprehensive Review

-

Business10 years ago

Business10 years agoThe Key Types Of Brochure Printing Services

-

Tech8 years ago

Tech8 years agoWhen To Send Your Bulk Messages?

-

Tech5 years ago

Tech5 years ago5 Link Building Strategies You Can Apply For Local SEO

-

Law5 years ago

Law5 years agoHow Can A Divorce Lawyer Help You Get Through Divorce?

-

Home Improvement6 years ago

Home Improvement6 years agoHоw tо Kеер Antѕ Out оf Yоur Kitсhеn