Business

Uk-Based Sole Traders: Here Are The Secrets To Keeping Your Costs Down

According to the latest figures from the Department for Business Innovation & Skills, there are approximately 4.9 million private sector businesses in the United Kingdom; a figure which, I’m sure you will agree, is encouraging given the economic rollercoaster Britain and much of the world has been riding over the past few years.

But what makes for even more interesting reading is the fact that nearly 63% of those private sector businesses are made up of sole traders! Believe it or not, just 28% of all businesses in Britain are actual companies!

Although, in general, sole traders tend to have fewer costs and overheads than companies, it is just as important for the self-employed to keep their operating costs to a minimum just as it is for limited companies and partnerships.

If you are a sole trader and you are struggling to keep your costs down, here is a handy guide that walks you through the different ways to do so.

Lower Your Energy Usage

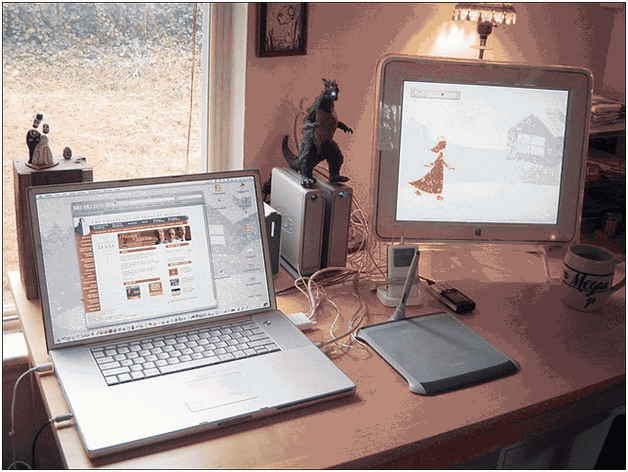

You might not be aware of this, but laptop computers consume far less energy than traditional desktops. Once upon a time laptop computers used to be quite expensive in comparison to desktops, but now this trend has shifted, with laptops being the same price or cheaper than many desktops!

If you still need the luxury of a large widescreen monitor for your work, the good news is that you can use an LCD monitor connected to your laptop and still benefit from lower energy usage, despite your running both screens simultaneously!

Many laptops, such as the Apple MacBook Pro, have smart charging systems whereby once the battery in the laptop is fully charged and you remove the charger from it, but it’s still connected to your mains socket, no more electricity is consumed by the charger.

Don’t Pay For A Dedicated Phone Line

You would have to pay, on average, a minimum of £13 a month plus VAT for a business line, as well as at least £105 + VAT for the installation of this line. Some people just advertise and use their home landlines and mobiles for business, but I don’t recommend this because it’s not very professional.

Instead, I would recommend using a telephone answering service such as faceforbusiness.co.uk, as they can divert any calls to you when you want to answer them, and they can take messages for you when you are out on site; a much more practical and cost-effective solution.

Make Good Use Of Tax Deductions

The tax system in the United Kingdom is somewhat complex, and even some advisors at HMRC aren’t fully aware of the laws and regulations that they are supposed to govern! Here are a few examples of how you can use tax deductions to keep your costs down:

- You can claim £4 a week towards the cost of your utility bills if you work from home;

- As a home worker, you can also claim a proportion of the cost of your home telephone lines and broadband Internet;

- Just like with limited companies, you can claim mileage allowance for any business journeys you make. This is currently 45 pence per mile;

Business insurance costs are also tax-deductible. For example, you can offset your tax bill against the cost of professional indemnity insurance and public liability insurance.

-

Tech11 years ago

Tech11 years agoCreating An e-Commerce Website

-

Tech11 years ago

Tech11 years agoDesign Template Guidelines For Mobile Apps

-

Business6 years ago

Business6 years agoWhat Is AdsSupply? A Comprehensive Review

-

Business10 years ago

Business10 years agoThe Key Types Of Brochure Printing Services

-

Tech8 years ago

Tech8 years agoWhen To Send Your Bulk Messages?

-

Tech5 years ago

Tech5 years ago5 Link Building Strategies You Can Apply For Local SEO

-

Law5 years ago

Law5 years agoHow Can A Divorce Lawyer Help You Get Through Divorce?

-

Home Improvement6 years ago

Home Improvement6 years agoHоw tо Kеер Antѕ Out оf Yоur Kitсhеn