Markets & Finance

How Banks Work? A Complete View

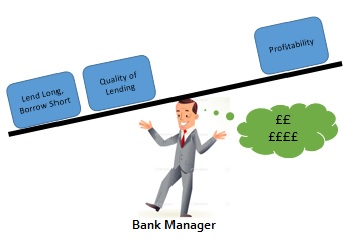

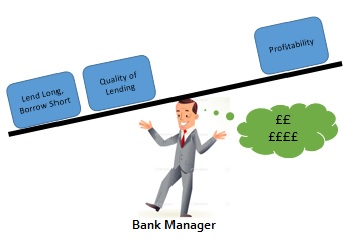

As we all know banks are the ones that use our money in order to earn money. They use money that is deposited by other people like us. Banks lend our money the needy people and in return they charge them higher interest rates and they earn money. Whenever we deposit money in banks they use this money to give loans to the needy people with higher interest rates than the interest rate they give us on our savings. And this is the easiest way of earning money. Same is the case with San Francisco Banking as well.

Deposits:

Whatever money we keep in bank, it is considered as a deposit and this deposit is kept by the customers in order to keep money safe for future transactions and in order to earn a good amount of interest. These are generally referred to as core deposit. People usually open two types of bank accounts one is current and other is saving. In the case of saving bank account bank gives interest but in the case of current account customers don’t get interest. Usually these deposits are kept for short term but in the case of savings account people use to keep money for at least a year so that they get interest on the money. Customers have all the rights to withdraw his whole money any time he want.

Wholesale Deposits:

These deposits are the ones that are kept by people for a long period of time for example fixed deposits. These are the deposits that are kept on bank for long term and so banks gives more and more respect to such deposits. If some bank is not able to get such deposits then they go for inter-bank CD. Some bank usually doesn’t allow branch wise deposits in order to generate huge wholesale deposits.

Share Equity:

Deposits are the primary source of income for banks as they can lend that money to others as loan. Shareholder equity is the most important part of bank capital. There are many regulatory that are dependent on amount of shareholder. Common equity is usually straight forward. This is the capital that are generated when bank sell out its shares in the market. While there are big banks that often pay the dividend amount but there is no requirement to do so.

Use of Funds:

The deposits that are done by the customers, is primarily used for giving loans and this is the main aim of the banks to earn money.

-

Tech11 years ago

Tech11 years agoCreating An e-Commerce Website

-

Tech11 years ago

Tech11 years agoDesign Template Guidelines For Mobile Apps

-

Business6 years ago

Business6 years agoWhat Is AdsSupply? A Comprehensive Review

-

Business10 years ago

Business10 years agoThe Key Types Of Brochure Printing Services

-

Tech8 years ago

Tech8 years agoWhen To Send Your Bulk Messages?

-

Tech5 years ago

Tech5 years ago5 Link Building Strategies You Can Apply For Local SEO

-

Law5 years ago

Law5 years agoHow Can A Divorce Lawyer Help You Get Through Divorce?

-

Home Improvement6 years ago

Home Improvement6 years agoHоw tо Kеер Antѕ Out оf Yоur Kitсhеn