Finance

Under The Banking System, History and Types

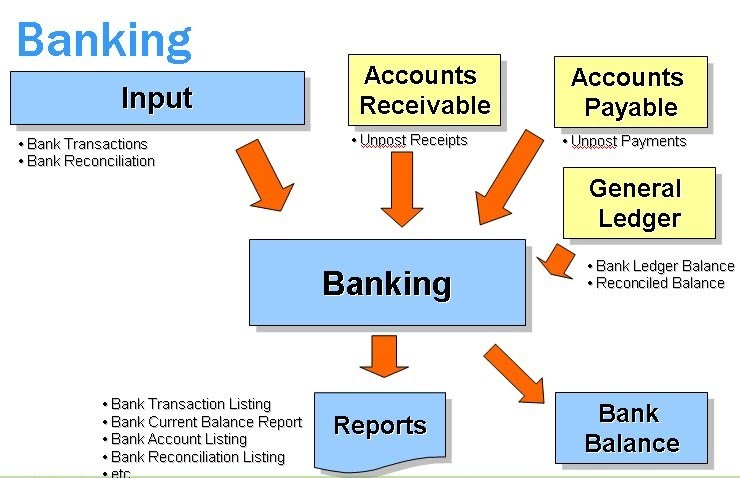

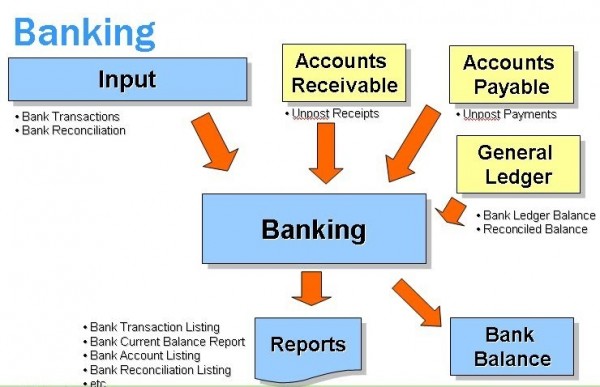

A system of a community or grid of an organization that provide monetary services is a banking system. The dominant banking systems are those systems which are made up of economical, national and financial banks.Approval unions are also a part of banking system.

What is a Bank?

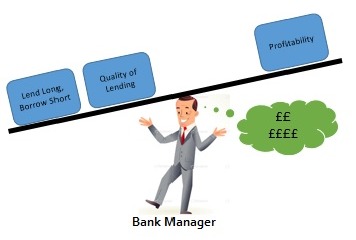

A business organization that makes approval by loaning money to an asker is a bank. Thus, creating a corresponding payment on the balance sheet of the bank. Loaning procedures are executed by principal markets either directly or indirectly. Banks are highly synchronized in

most of the countries of the world because of their significance in the monetary system and their impact on national markets. Reserving banking is organized by most of the nations in the world. Bank keeps liquid properties which are equivalent to only a part of their present responsibilities. San Francisco Bank understand their responsibility and provide services accordingly.

Banking began with the orthodox banks or can be said conventional banks of merchants of the bygone world, who used to lend grain loans to countrymen and businessmen who used to supply stocks throughout cities. This began in Assyria and Babylonia around 2000 BC. Erstwhile, the bestowals founded in temples used to give loans in former time of Greece during the colonial period of Romans and added two significant customs in loaning: they accepted installments in exchange of money. Excavations proves loaning system was also practiced in India and China in ancient period.

Types of Banking Systems:

- Commercial Banks

Banks such as community banks, who accept installments and offer loans to trading and askers, are commercial banks. Consumer can open checking/saving accounts at a commercial bank by appealing for car loans and home loans towards your checking or savings accounts. Commercial banks also provide services for loans, transferring monetarism, or paying bills. There are commercial banks providing indemnities, investment, and pension plans also. Some commercial banks observed under federal deposit insurance corporation (FDIC) and federal reserve bank. However, community and commercial banks are authorized by the particular state in which they trade.

- Central and National Banks

The federal deposit insurance corporation also assures national banks which are forfeiting partners of the Federal Reserve System and they are authorized by United States of America. Comparing to the local financial banks, they hold their branches in the cities which are commercial capitals of the certain nation. Although, national bank also provide the same service which commercial banks provide.

-

Tech11 years ago

Tech11 years agoCreating An e-Commerce Website

-

Tech11 years ago

Tech11 years agoDesign Template Guidelines For Mobile Apps

-

Business6 years ago

Business6 years agoWhat Is AdsSupply? A Comprehensive Review

-

Business10 years ago

Business10 years agoThe Key Types Of Brochure Printing Services

-

Tech8 years ago

Tech8 years agoWhen To Send Your Bulk Messages?

-

Tech5 years ago

Tech5 years ago5 Link Building Strategies You Can Apply For Local SEO

-

Law5 years ago

Law5 years agoHow Can A Divorce Lawyer Help You Get Through Divorce?

-

Home Improvement6 years ago

Home Improvement6 years agoHоw tо Kеер Antѕ Out оf Yоur Kitсhеn