Tech jargon in currency trading sound both sassy and saucy, but if it is unclear about what it is talking, it may land one in deep soup. That’s the ABC of moving ahead in stocks and forex trading and identifying the prowess of options trading indicators. The binaryoptionshub.com delivers its insights on the most crucial indicators that they have tried and tested.

Most Common Binary Options Indicators

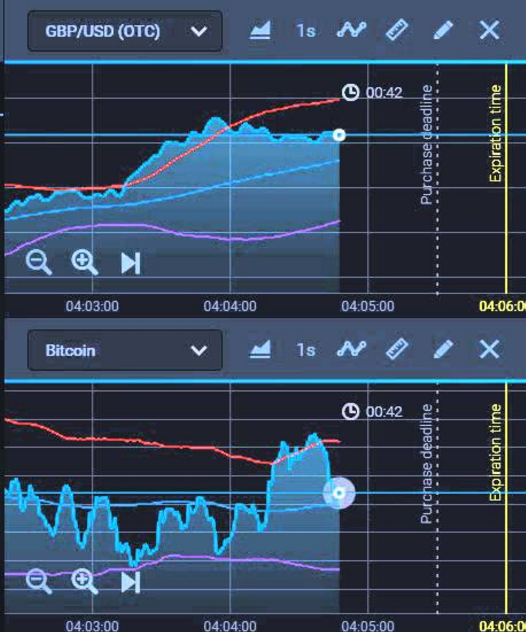

First comes the Moving Averages, the trend lines directing the path of a trend. This is suitable only for those investing for long-term binary options. This, however, must also be analyzed with other technical analysis indicators to see if the results are accurate. For example, if a trend has a weakness, it shall go a different way than it will without it. The Bollinger Bands show the weaknesses and is a tool that helps recognizing the market volatility. The tool expresses the possibilities of an opportunity; it is for the users to see if such a condition is ideal. This is where many people go wrong and take any lucrative-looking option to initiate a trade. The Moving Averages, thus, must be tallied with the Bollinger Bands to see if a trend is really moving toward yielding profit.

The Net Trader Positions, however, is more popular than the abovementioned ones; it looks up for contrary trades and 60-second binary options in the future foreign exchange trading markets. Foreseeing the major trends is a must if long-term profits are to be made.

George Lane’s conclusions on uptrend and downtrend market are best understood with the technical indicators, Stochastic and Relative Strength Index, used together. RSI gauges the strength of a certain price against the past conditions of the market to provide a clear idea of how strong the future market may become. The ADX (Average Directional Movement) finds the strongest trends and is a great tool to find opportunities for using the Stochastic and the RSI trading indicators. It’s sort of a firewall against contrary trends or other fears of losing money and gives out warnings in the presence of such dangers.

Lagging Binary Indicators

Now, all of them come under the broader category of the lagging and leading indicators. The Lagging Indicators follow a stock’s price pattern and function in the past data. They show pretty accurately the development of a trend or a stock’s position in a good trading range; but are not if the future rallies or pullbacks need to be predicted. It’s best to use them to watch the trends that have developed so far but not for predicting movements over the next few days. Some of the examples are moving average, MACD, and ADX.

Leading Indicators

Leading Indicators are just the opposite; they predict the possible future price rallies and crashes accurately. Many in this class are momentum indicators and analyze price movements of a stock’s price. Hence they are good to find out extreme fluctuations, follow slowdowns in stock prices, and avoid resulting pullbacks, for examples, RSI.

There’s nothing like total leading or total lagging; it depends on how well you mix the technical indicators in their correct proportions and use it in your binary options trading.